Make quicker and well-informed decisions

with real-time credit decisioning and risk

assessment

Relevant insights,

at your fingertips

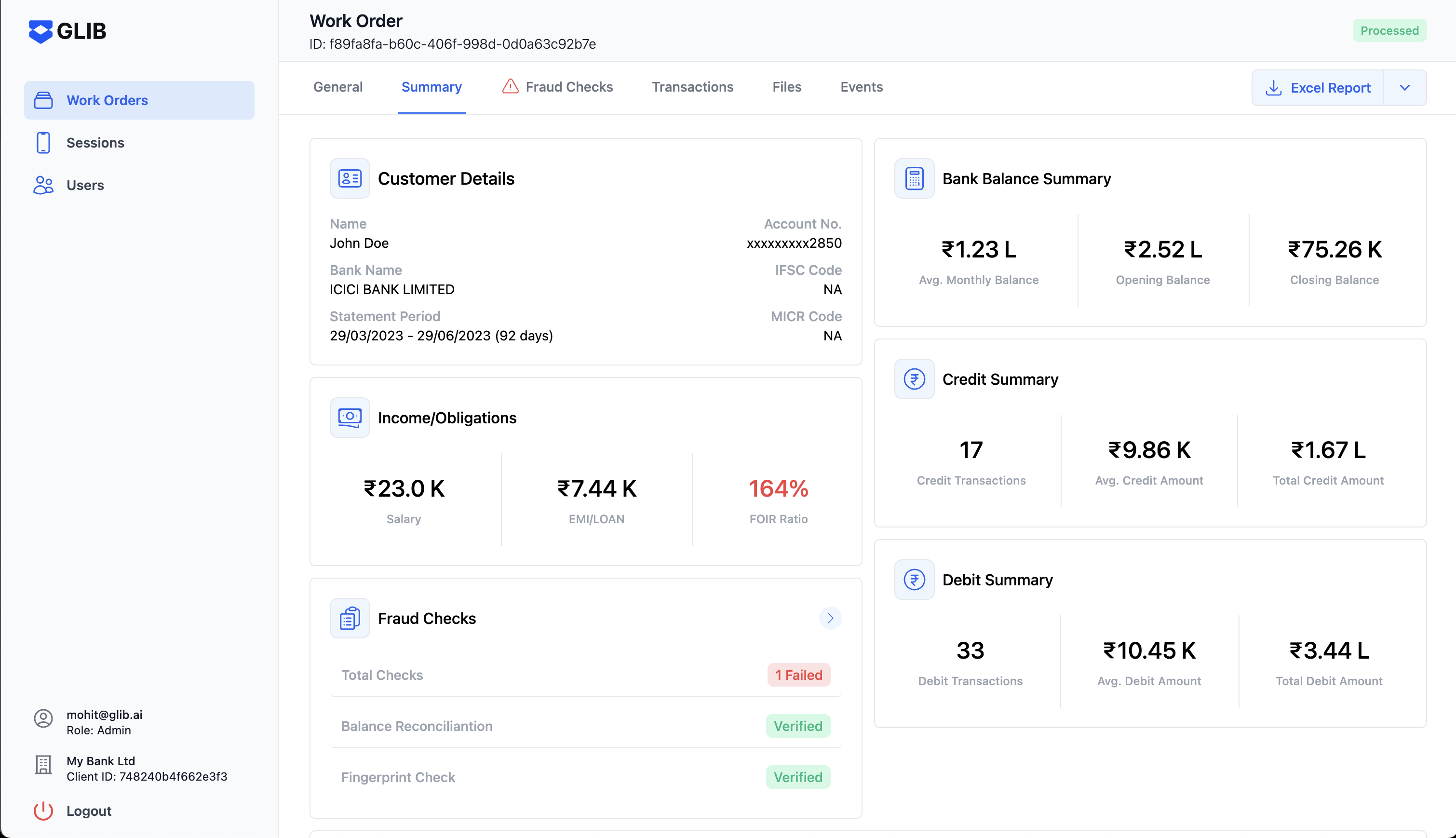

Assess credit worthiness with a complete financial health check and onboard your customers with confidence.

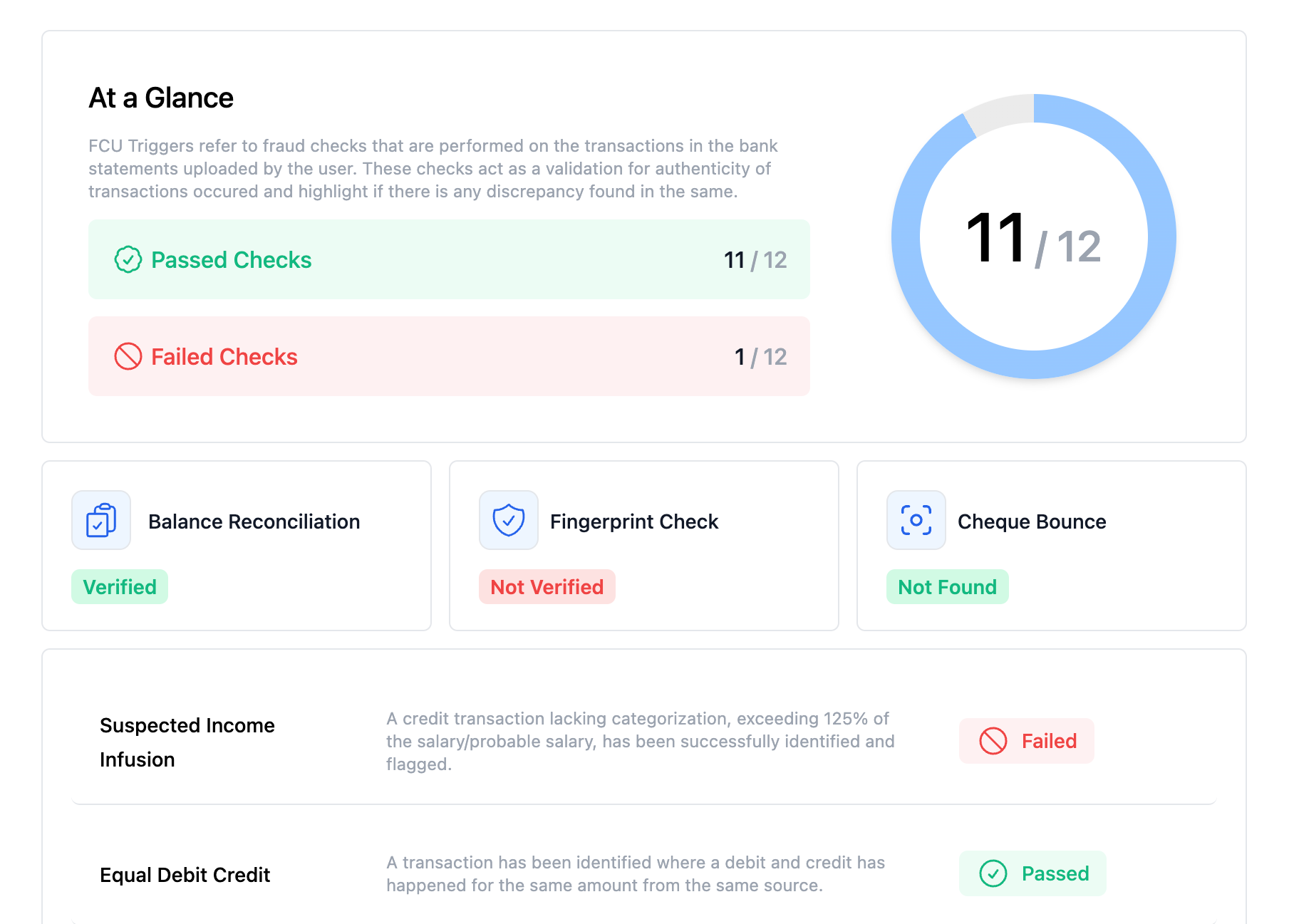

Physical → Digital

From agent-driven to self-service journeys, enable your customers to submit bank statements digitally, in a few simple steps.

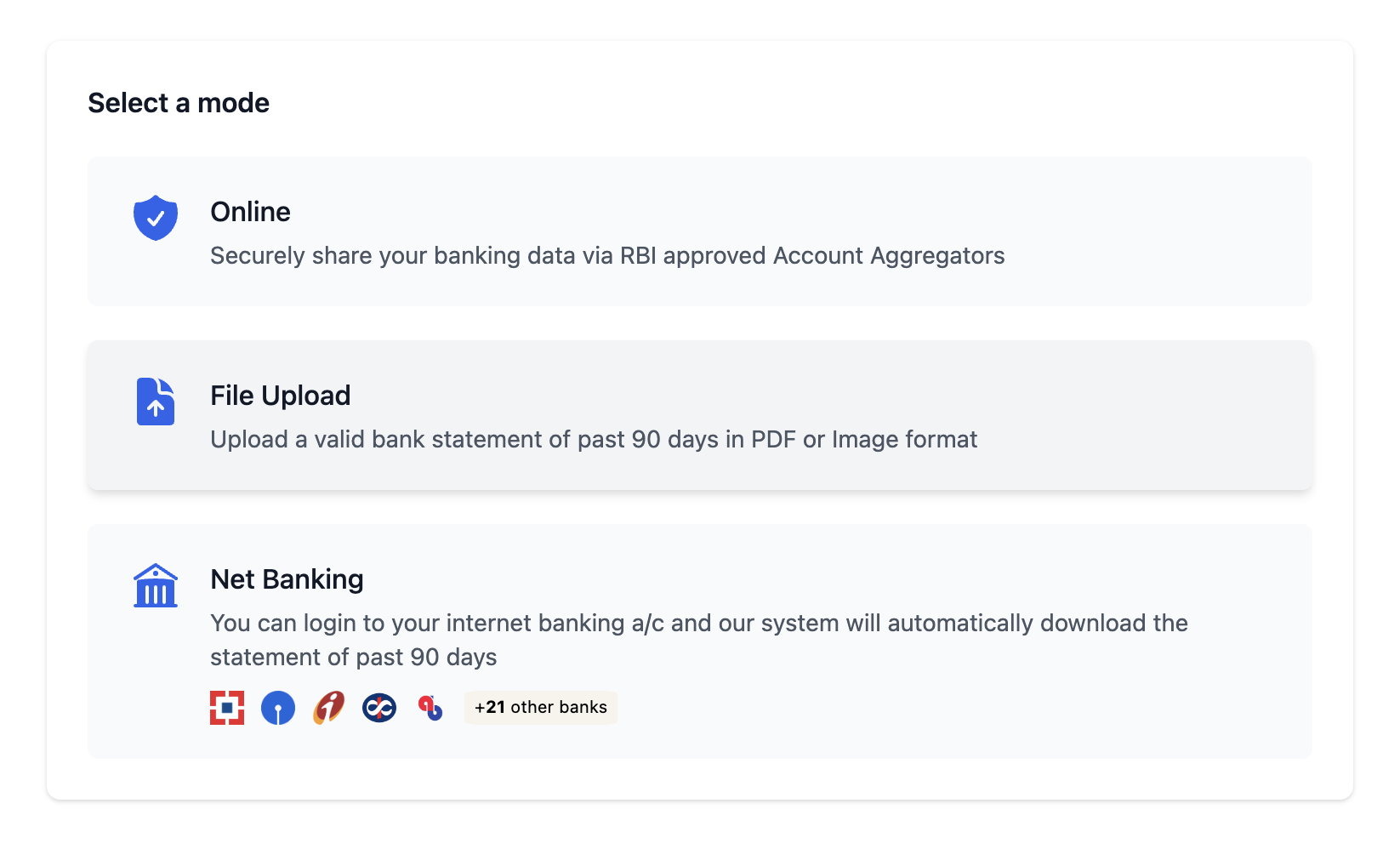

Intelligent automation

Eliminate operational bottlenecks and reduce manual effort to transform your workflows.

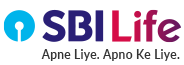

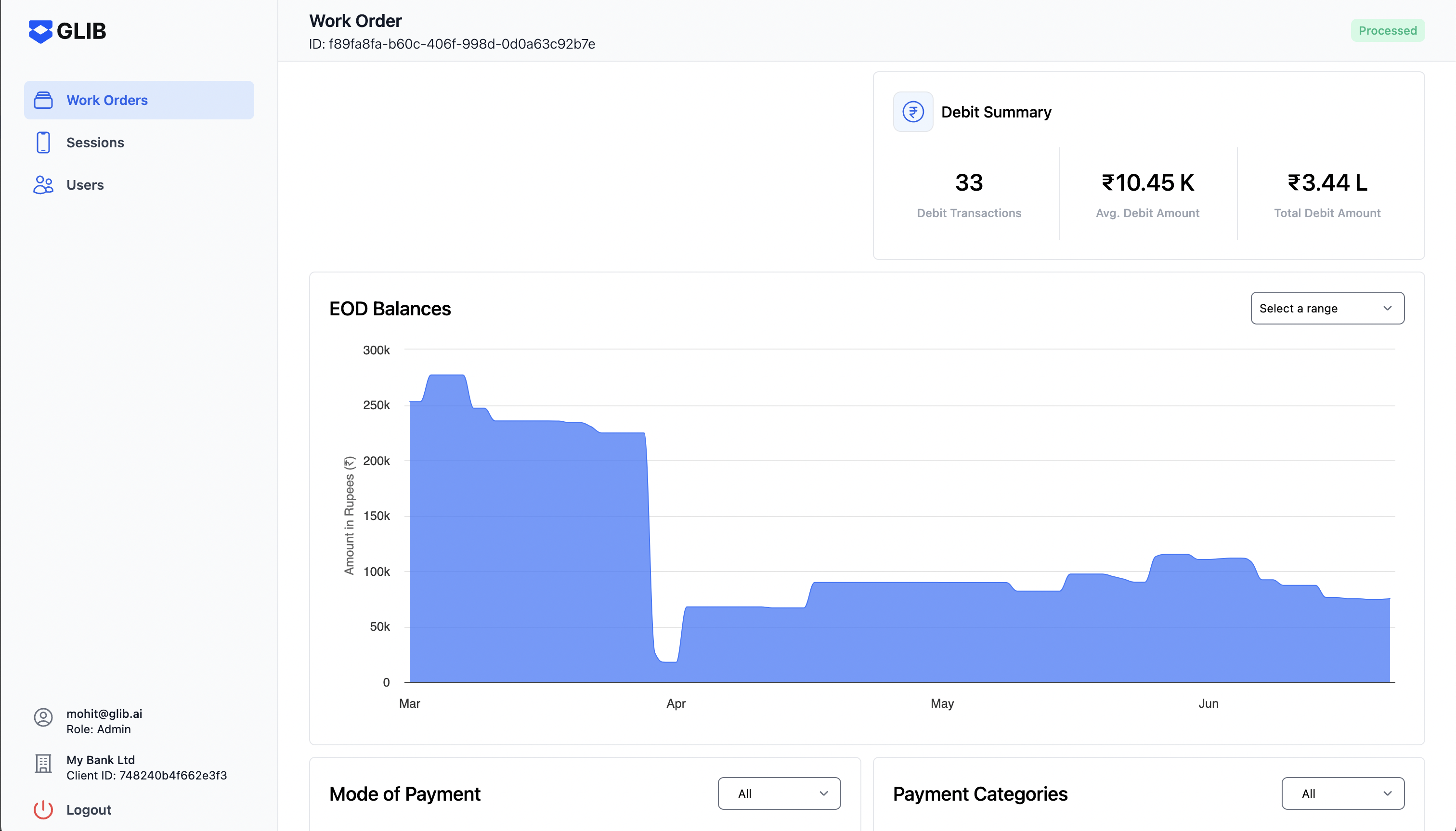

No blind spots and no guesswork. Onboard and lend with confidence.

Identify and consolidate related-party transactions and key financial ratios across multiple bank accounts.

Detect income-related transactions such as salary, dividends, deposits & other miscellaneous sources.

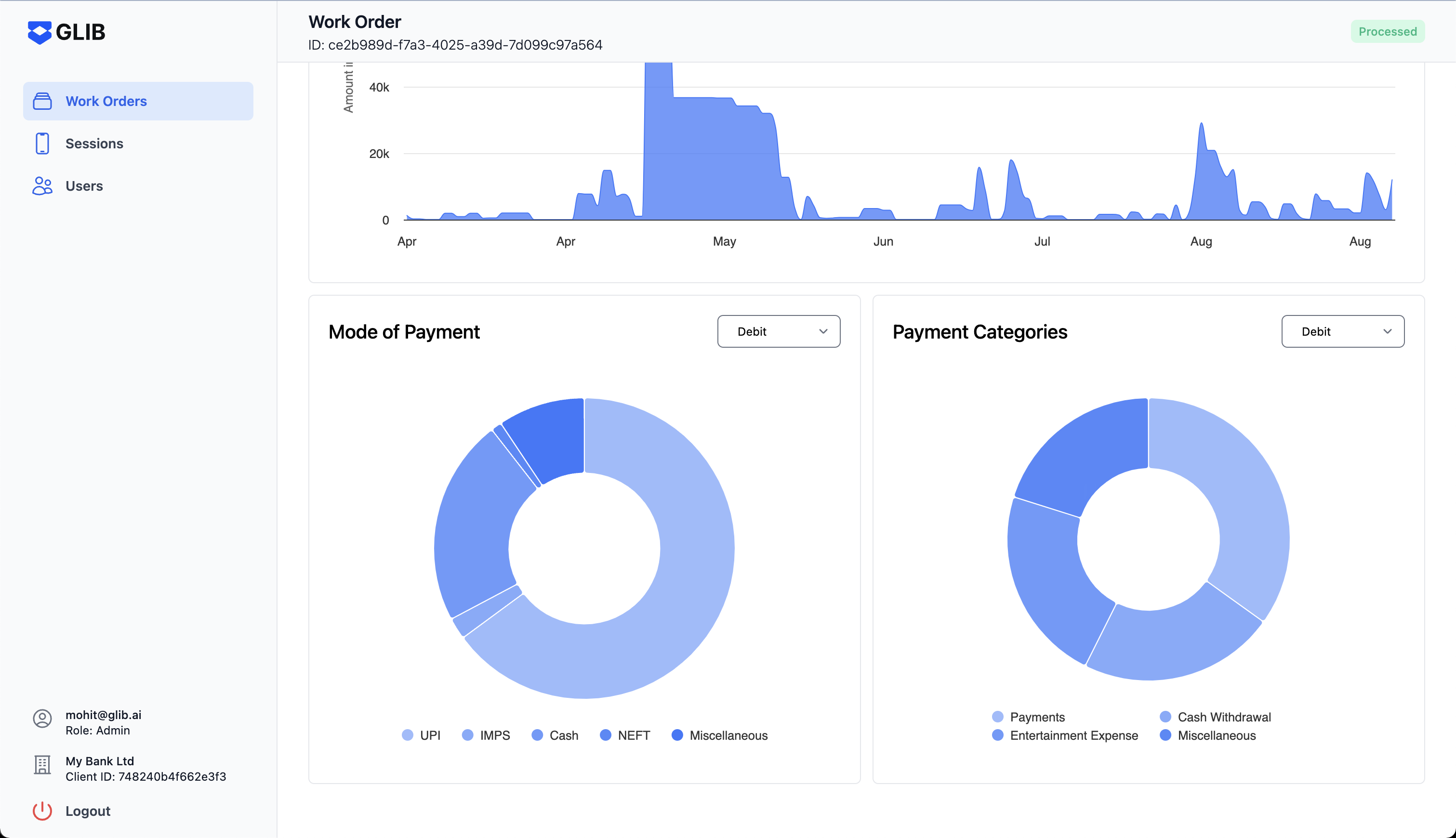

Smart categorization provides a comprehensive analysis of your borrowers’ expenses, EMIs & spending habits.

Assess a business"s ability to repay loans by evaluating its financial health and operational efficiency

Learn how AI-powered insights can help you eliminate bottlenecks and transform your organization.